"The Federal Reserve, as

one writer put it, after the recent increase in the discount rate, is in the

position

of the chaperone who has ordered the punch bowl removed just

when the party was really warming up."

William McChesney Martin, October 19, 1955

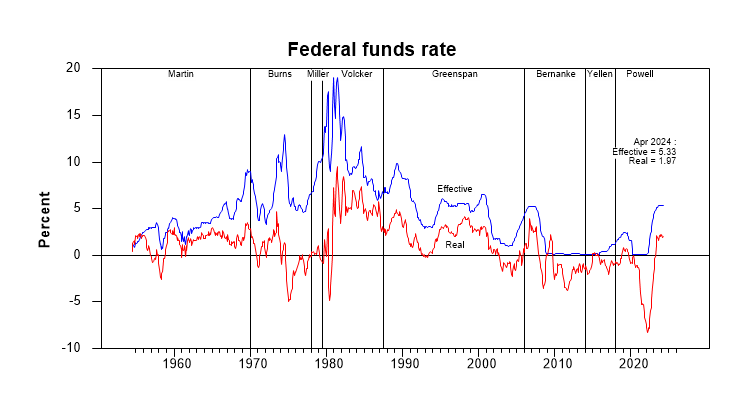

The federal funds rate is one of the principal tools of monetary policy in the United States. Although the Federal Reserve has other means at its disposal to influence money and prices, research has shown that changes in the federal funds rate are a good proxy for changes in the stance of monetary policy, increasing the rate to tighten and lowering it to ease. In fact, monetary policy announcements since the 1990s have reported a target level or range for the federal funds rate so as to inform the public about the Fed's decision.

The Federal Funds Rate and the Stance of Monetary Policy

In the article "Measuring Monetary Policy," Quarterly Journal of Economics, August 1998, Ben S. Bernanke and Ilian Mihov look for a simple measure of the tighteness of monetary policy in the United States at any given time. They find that the federal funds rate "appears to be (marginally) the best choice for the sample period as a whole" from 1965 to 1996. The caveat is that non-borrowed reserves do better in the bumpy early-Volcker period from 1979 to 1982, though that measure is "otherwise strongly rejected."

The graph below shows the monthly course of the federal funds rate from 1954 to the present, with labels identifying the time periods corresponding to each custodian of the proverbial punch bowl. The figure shows both the effective nominal rate tested by Bernanke and Mihov and a simple measure of the real rate obtained by subtracting inflation (consumer price index) over the previous twelve months.