The Risk-Taking Channel of Monetary Policy

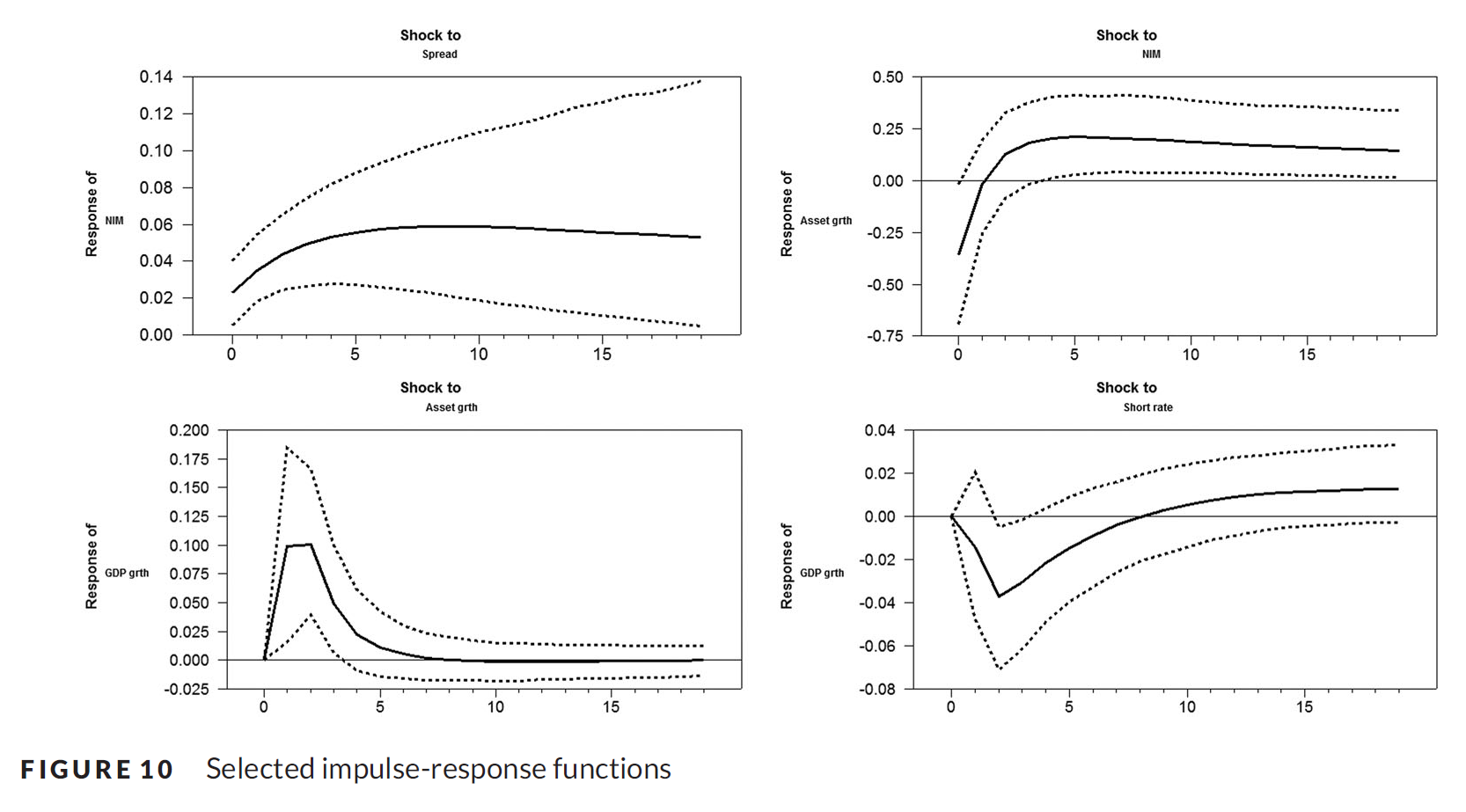

In an award-winning article, Adrian, Estrella and Shin (2019) provide evidence that the yield curve is not simply a leading indicator of recessions, but that the two are connected as links in a causal monetary policy chain that runs from the federal funds rate to the level of real economic activity. Changes in the short-term federal funds rate affect both the slope of the yield curve and the net interest margin of financial intermediaries. The intermediaries in turn must strike a balance between risk and return in the volume of credit they provide. As net interest margin declines and risk increases, credit extension declines, with ultimate repercussions on the aggregate level of real economic activity. The figure below gives a glimpse into the empirical relationships uncovered in the paper.

The article concludes that "The insights of this paper restore a connection between 'quantities' and 'prices' in the transmission of monetary policy. However, in contrast to the traditional monetary literature, the crucial ingredient to the relation between quantities and prices is not the money demand function, but rather the connection between interest rate policy and financial intermediary balance sheet management."

Reference

Tobias Adrian, Arturo Estrella and Hyun Song Shin (2019), "Risk-taking channel of monetary policy." Financial Management 48, 725-738. Best paper award from the editors of the journal.